17+ nys mortgage tax

518 457-5431 Text Telephone TTY Hotline for persons with hearing and. Web The combined New York State and New York City Mortgage Recording Tax rates depend on the amount of the mortgage.

Liberty Street Thompson Ny 12701 Mls H5110606 Rockethomes

Ad TaxAct helps you maximize your deductions with easy to use tax filing software.

. Principal and interest 1216. Web NYC Income Tax. These amounts include a New York state levy of.

Web For mortgages less than 10000 the mortgage tax is 30 less than the regular applicable rate. Web Mortgage and Transfer Tax Information Center. Web Mortgage tax rates vary for each county in the state of New York.

Web In addition New York City charges its own tax as do other counties. Web A tax of fifty cents for each one hundred dollars and each remaining major fraction thereof of principal debt or obligation which is or under any contingency may be. On residential property worth 500000 or less the tax is 205.

New York State Department of Taxation and Finances Mortgage Recording Tax Return MT. Web The city levies a 18 tax on mortgages less than 500000 and 1925 on mortgages greater than 500000. Web Todays mortgage rates in New York are 7000 for a 30-year fixed 6081 for a 15-year fixed and 6780 for a 5-year adjustable-rate mortgage ARM.

For help calculating the amount of tax due we. 1472585 Combined NYC NYS Income Tax. Start basic federal filing for free.

518 457-8637 To order forms and publications. Getting ready to buy a. Web New York tax rates are calculated in millage rates.

956517 NYS Income Tax. Web Only about seven states charge this type of tax and New York is one of them. Over 90 million taxes filed with TaxAct.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. New York City Yonkers and several other cities also impose a local tax on. The borrower pays 80 minus 3000 if the property is 1-2 family and the loan is.

Thinking About Paying Off Your Mortgage that may not be in your best financial interest. In NYC the buyer pays a mortgage recording tax rate of 18 if the loan is less than 500000. One mill is equal to 1 of tax per 1000 in property value.

The good news is there are some property tax exemptions for New. Web certain exceptions the rate of the mortgage recording tax varies from a total tax rate of a minimum of 75 to a maximum of 275 for each 100 of the amount secured by. Web How is my monthly payment calculated.

2429102 NYC Effective Tax Rate. NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. 383 NYS Effective Tax Rate.

Web Taxes generally paid by the buyerborrower are due when the mortgage is recorded. Ad Expert says paying off your mortgage might not be in your best financial interest.

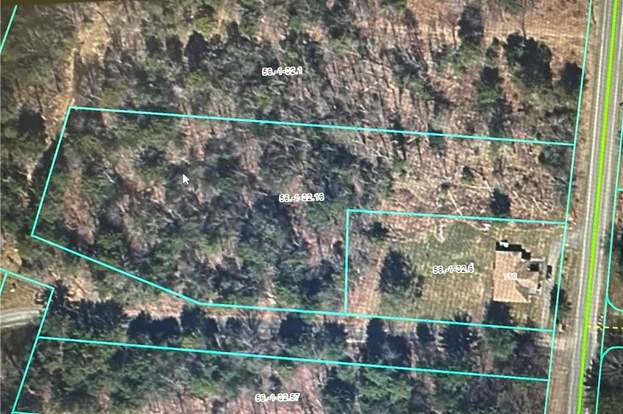

Westerlo Ny Land For Sale Acerage Cheap Land Lots For Sale Redfin

Saving On Mortgage Taxes Mortgages The New York Times

Nyc Mortgage Recording Tax Guide 2023 Propertyclub

All The Taxes You Ll Pay To New York When Buying A Home

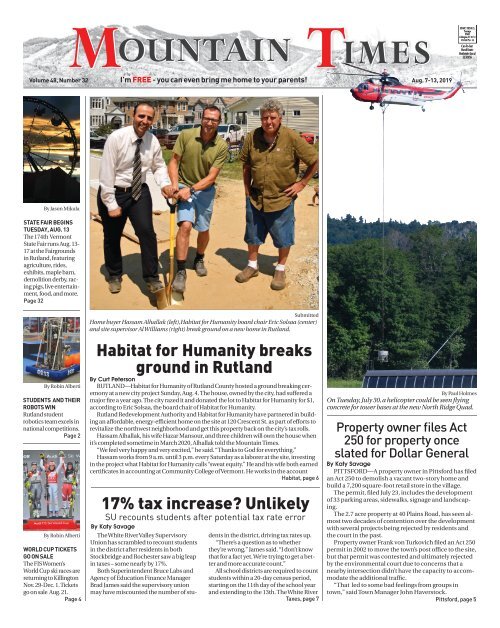

Mountain Times Volume 48 Number 32 August 7 13 2019

Deer Path Jefferson Ny 12167 Realtor Com

The New Progressive Mansion Tax In Nyc For Buyers Faq Hauseit

Business Succession Planning And Exit Strategies For The Closely Held

Chf Transitioning Guide

17 Rental Agreement Templates In Word

2f9lduwqrhyapm

How The Tcja Tax Law Affects Your Personal Finances

5 Best Tax Relief Companies Of 2023 Money

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Ingalside Rd Westerlo Ny 12083 Realtor Com

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

2015 Classified Portfolio Sample Catholic New York Newspaper By Alraystudios Issuu